Airbnb Decline in Cheltenham: A Step Toward Housing Recovery?

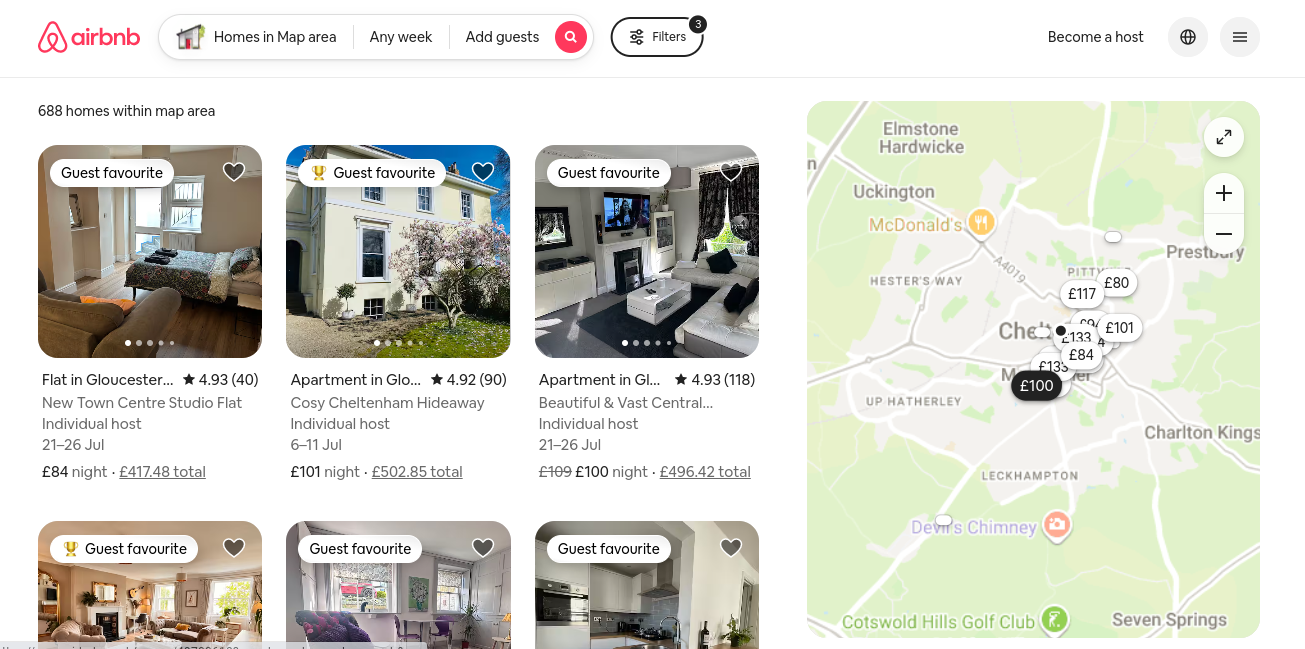

The Cheltenham Tenants Union welcomes a notable decline in the number of whole properties listed as Airbnbs in our town, a shift that could signal relief for the strained residential housing market. Recent data shows a drop from a peak of 754 whole properties to 688, representing homes with one to four bedrooms taken out of the residential market for short-term lets. While this reduction is a positive development, we remain cautious, as the fate of these 63 properties remains unclear. Are they returning to long-term rentals or the housing market, or are they simply sitting empty? Without council monitoring, we lack definitive answers, but this trend offers a glimmer of hope for tenants and prospective homeowners alike.

The Impact of Airbnb on Cheltenham's Housing Crisis

The Cheltenham Tenants Union has long highlighted the detrimental impact of short-term lets, such as those on Airbnb, on our local housing market. Whole properties that could house families, key workers, or young professionals are increasingly converted into what we call the "pop-up hotel market." This practice exacerbates the housing shortage, driving up rents and property prices while reducing the availability of long-term rentals. In a town like Cheltenham, where housing affordability is already a pressing issue, the loss of hundreds of homes to short-term lets has been a significant blow to our community.

The private rented sector in the UK has faced intense pressure, with supply unable to meet demand. Recent figures suggest that the number of rental properties is down 20% compared to pre-pandemic levels, pushing rents to new highs. In Cheltenham, the proliferation of Airbnbs has compounded this crisis, as landlords opt for the higher profits of short-term lets over stable, long-term tenancies. The result is fewer affordable homes for residents, leaving many tenants struggling to secure stable housing.

A Welcome Decline, But Questions Remain

The drop from 754 to 688 whole properties listed on Airbnb is a step in the right direction. This reduction suggests that fewer homes are being siphoned off into the short-term rental market, potentially easing pressure on the residential housing supply. The Cheltenham Tenants Union views this as a victory for our advocacy efforts, which have consistently called for measures to prioritise long-term housing over profit-driven short-term lets.

However, we cannot assume that these 63 properties have automatically returned to the residential market. In the best-case scenario, they are now available as long-term rentals or for purchase, helping to address the housing needs of Cheltenham residents. In the worst case, they may be sitting empty, a trend seen in other areas with high second-home ownership, such as Cornwall, where local families are priced out while properties remain vacant. Without active monitoring by Cheltenham Borough Council, we lack the data to confirm how these homes are being used, leaving a critical gap in our understanding of the local housing landscape.

The Broader Context: Policy Changes and Market Shifts

This decline in Airbnb listings comes amid broader shifts in the UK housing market. The Renters' Rights Bill, set to introduce significant protections for tenants, including a ban on no-fault evictions and limits on mid-contract rent hikes, may be influencing landlords' decisions. Some landlords, facing stricter regulations and reduced profitability in the private rented sector, may be exiting the short-term let market. However, there's a risk that these reforms could prompt some to sell properties or leave them vacant, further complicating the housing supply issue.

Additionally, recent reports indicate a cooling in the UK housing market, with house prices falling by 0.8% in June 2025, the sharpest decline since November 2022. This softening, partly attributed to the expiration of stamp duty discounts, could be deterring speculative investment in properties for short-term lets. In Cheltenham, where tourism fuels demand for Airbnbs, such market dynamics may be contributing to the observed decline.

Understanding the Platform Divide

An intriguing aspect of this trend is the divergence between platforms. While Airbnb listings for whole properties have dropped by approximately 10%, Booking.com listings for similar properties have remained stable over the past year. This contrast raises questions about the types of landlords using these platforms and whether the 63 fewer Airbnb listings signal a return of homes to the residential market.

The differing trends between Airbnb and Booking.com suggest distinct user bases for these platforms. Airbnb has long been associated with "amateur" or casual landlords, homeowners renting out their properties or spare rooms for supplementary income, often driven by the platform's ease of use and appeal to the sharing economy. In contrast, Booking.com tends to attract more professional operators, such as serviced apartment companies or property management firms, which cater to a broader range of accommodation, including corporate stays and holiday lets.

The 10% decline in Airbnb listings could indicate that amateur landlords are exiting the short-term rental market in Cheltenham. Several factors might be driving this shift. Regulatory and economic pressures, such as the abolition of tax breaks for furnished holiday lets effective April 2025, may disproportionately affect amateur landlords who rely on Airbnb's higher yields to offset costs. Professional operators, with economies of scale and diversified portfolios, may be better equipped to absorb these changes, maintaining their presence on Booking.com.

Rising interest rates and the cost-of-living crisis have squeezed smaller landlords, particularly those with buy-to-let mortgages. Some may be selling properties or switching to long-term rentals to secure stable income, as short-term lets require more hands-on management. In Cheltenham's tourism-driven economy, fueled by events like the Cheltenham Festival, amateur landlords may find the seasonal nature of demand less viable than professional firms, which can leverage Booking.com's broader reach to maintain consistent bookings.

Are These Properties Returning to the Residential Market?

The Cheltenham Tenants Union would like to believe that the 63 properties no longer listed on Airbnb have been returned to the residential market as long-term rentals or homes for purchase, alleviating pressure on Cheltenham's housing supply. However, without council monitoring or published data, this remains speculative. Several scenarios are possible.

Some properties may have shifted to long-term rentals, driven by the upcoming Renters' Rights Bill, which strengthens tenant protections and may encourage landlords to favour stable tenancies over short-term lets. Alternatively, these homes could be sitting empty, as seen in areas like Cornwall, where second homes often remain vacant. Some may have been sold to owner-occupiers or investors, but there's no guarantee they've re-entered the rental market.

The lack of transparency from Cheltenham Borough Council on property usage is a significant barrier to understanding these shifts. Unlike cities like London, where regulations such as the 90-day rule are enforced, Cheltenham has no specific cap on short-term lets, and local authorities do not systematically track whether properties revert to residential use. This gap in oversight underscores the need for a local registration scheme, similar to proposals in England, to monitor short-term lets and their impact on housing.

Implications for Cheltenham's Housing Market

The decline in Airbnb listings is a hopeful sign, as it suggests a potential reduction in the number of homes lost to the "pop-up hotel market." However, the stability of Booking.com listings indicates that professional operators continue to dominate a portion of the short-term rental market, potentially limiting the number of homes available for long-term residents. The private rented sector remains under strain, with rental supply 20% below pre-pandemic levels and rents rising, though at a slower pace of 2.8% annually as of April 2025.

The possible exit of amateur landlords from Airbnb could reflect a broader trend of smaller-scale landlords leaving the market entirely, as seen nationally, where 47% of landlords are considering selling due to regulatory and economic pressures. If these 63 properties have indeed returned to the residential market, they could provide much-needed relief for tenants facing fierce competition for affordable homes. However, without data, we cannot rule out the possibility that these properties are vacant or being used for other purposes, such as second homes.

Our Call to Action

While the reduction in Airbnb listings is encouraging, the Cheltenham Tenants Union urges vigilance and proactive measures to ensure these homes benefit the local community. We call on Cheltenham Borough Council to implement a robust system to track the use of properties previously listed as Airbnbs. Without data, we cannot confirm whether these homes are returning to the residential market or sitting idle.

We also urge the council to strengthen regulation by following the lead of places like Brighton and Hove, where councils are cracking down on rogue landlords using Airbnbs to dodge tax and housing regulations. Local policies could limit the number of whole properties used for short-term lets, prioritising long-term housing. The council should also work with tenants and advocacy groups to ensure the Renters' Rights Bill delivers tangible benefits, such as affordable rents and secure tenancies, without unintended consequences like reduced rental supply.

A local registration system for short-term lets, as proposed nationally, would provide clarity on how properties are being used and ensure compliance with housing regulations. The council should track whether former Airbnb properties are returning to the residential market, preventing them from sitting empty or being repurposed for non-residential use. Collaboration with tenants, landlords, and advocacy groups is essential to develop policies that prioritise long-term housing while balancing Cheltenham's tourism economy.

A Community Vision for Housing

The Cheltenham Tenants Union stands for a housing market that prioritises people over profit. Every home taken out of the pop-up hotel market is a potential opportunity to provide a stable, affordable place to live for our community. While the drop from 754 to 688 Airbnb listings is a positive sign, it's only a start. We remain committed to advocating for policies that protect tenants, increase housing supply, and ensure Cheltenham remains a place where everyone can afford a home.

The 10% drop in Airbnb listings, contrasted with stable Booking.com numbers, suggests that amateur landlords may be retreating from the short-term rental market in Cheltenham, possibly due to economic pressures or regulatory changes. While we hope this means more homes are available for long-term tenants or buyers, the lack of council monitoring leaves us in the dark. The Cheltenham Tenants Union remains cautiously optimistic but calls for greater transparency and action to ensure these properties serve the needs of our community.

By prioritising residents over short-term profits, Cheltenham can move closer to a fairer, more affordable housing market. Join us in pushing for a fairer housing future. Together, we can ensure that Cheltenham's homes are for living in, not just for profiting from.